ALL IRAN NEEDS TO DO IS TO SURVIVE.

March 6, 2026 9 Comments

This WordPress.com site is dedicated to independent working class politics. Contact me at briangreen@theplanningmotive.com

March 2, 2026 Leave a comment

I delayed this article until the oil markets opened on Sunday evening to view the oil price following the outbreak of the war and the closure of the Straits of Hormuz.

February 20, 2026 4 Comments

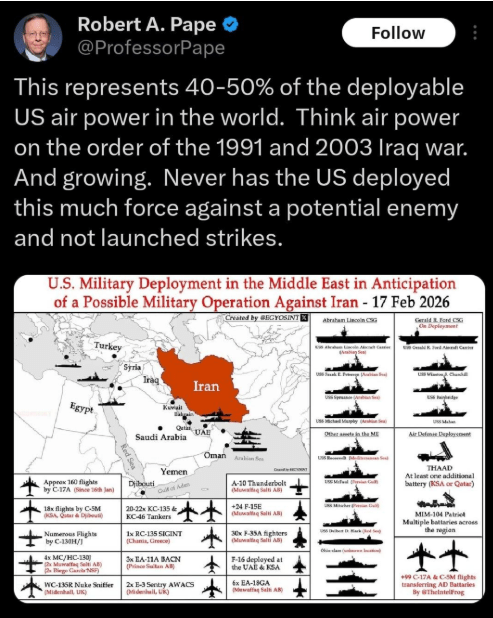

This confirms everything I have said in the article. The US is gearing up for total war. China will need to respond. If the US suffers substantial losses this will compromise any future attack on China. In addition Trump has invited himself to Beijing at the end of March. Clearly by crushing Iran and isolating President Xi he hopes to dominate the meeting forcing his agenda on China. I also urge the reader to consult my earlier articles on Iran and US Chinese relations.

Recent Comments